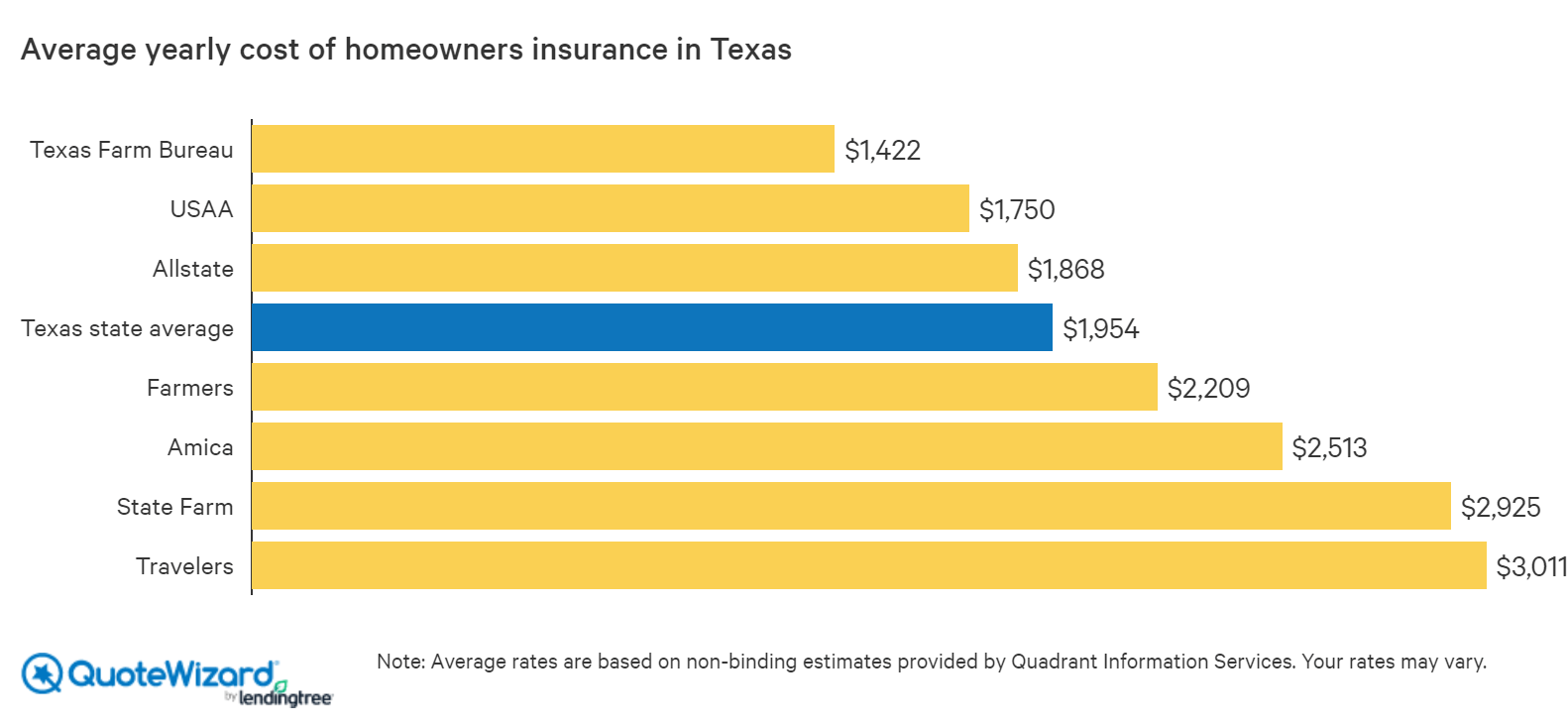

We did a thorough analysis of the rate of house owners insurance coverage for every ZIP code in Texas and found which insurance providers offer the most affordable rates. For our sample home, Chubb and USAA offered the outright least expensive cost, with yearly averages of $1,436 and $2,030, respectively. Nevertheless, the typical house owner may have some difficulty acquiring coverage from these two business, as Chubb mostly sells insurance coverage to owners of high-value homes, and USAA is restricted to people affiliated with the U.S.

For those who can't benefit from these business' special costs, the most inexpensive choices are Progressive and Nationwide. As the largest of the 48 continental United States, Texas deals with a wide variety of house owners insurance perils. For house owners living near the Gulf of Mexico, the primary local risk is damage from typhoons and other storms; meanwhile, houses even more inland are susceptible to wildfires and twisters.

The excellent news is that damage due to wind is basically always covered by house owners insurance if wind breaks a window or results in your roofing system requiring repair work, your homeowners insurance will cover the expenses. However, damage due to flooding, whether from a cyclone or another source, is practically never ever covered by property owners insurance.

If your home is at threat of flooding, you have two primary options for flood insurance: an NFIP policy backed by the federal government (with standardized rates and coverage levels across every insurance company) or a totally personal policy where rates and protection alternatives vary by business. Till just recently, personal flood insurance policies were excessively pricey, however they've become far more competitively priced.

Wildfires are a specific issue for the western parts of Texas, where conditions tend to be drier and more vulnerable to fire. Fortunately, fire damage is often covered by property owners insurance coverage, so you'll be protected by your policy so long as you have a sufficient dollar quantity of protection.

While twisters normally do not trigger as much widespread damage as a cyclone, tornadoes can often appear with little or no warning. This means you won't have much time, if any, to prepare before one kinds. And when they've formed, tornadoes normally have a travel speed of around 30 miles per hour however can move up to 70 mph in the best conditions.

Luckily, from an insurance coverage point of view, tornadoes are relatively simple to cover. Most tornado damage is because of wind, which is covered by property owners insurance. Other sources of tornado-related damage, like hail, usually are included, but can differ by insurer and area; so double-check your policy to understand what perils you're safeguarded from.

Nevertheless, if you're having difficulty making homeowners insurance payments due to monetary hardship, you may be eligible to postpone payment in order to avoid having your policy cancelled. Sadly, you can also anticipate that any home insurance coverage declares you do make during this time are likely to be postponed. The governor has suspended some claim dealing with deadlines, and insurance companies may have restricted staff readily available to manage claims.

In addition to a statewide cost analysis, we also took a look at the cost of property owners insurance coverage for the major cities in Texas. For every single city with a population over 50,000, we determined the common price homeowners can anticipate to pay because city, in addition to how that rate compares to the statewide average.

Like other seaside states exposed to hurricane activity, Texas needs to handle increased threat of wind damage. The potential for twisters and wildfires in the state likewise make it an expensive market for house insurance.